Who Are the Leading Manufacturers of Metalized PET Films Globally?

Metalized PET films are thin plastic sheets coated with a metal layer, mostly aluminum. These films improve barrier properties, blocking moisture, oxygen, and light. They are key in packaging, electronics, insulation, and decorative laminates. Their manufacturing is significant because these films protect products, extend shelf life, and improve energy efficiency in applications like aerospace and electronics.

What Are Metalized PET Films and Why Is Their Manufacturing Significant?

Metalized PET films are made by coating polyethylene terephthalate (PET) substrates with a thin metal layer. The metal gives the films excellent barrier properties against gas, moisture, and light. This extends product freshness in food packaging and protects sensitive components in electronics.

Manufacturing these films requires precision equipment to deposit uniform metal layers with good adhesion. Thickness typically ranges from 8 to 50 microns, with metal optical densities between 0.18 and 4.50, allowing control over barrier strength and appearance.

The significance lies in their wide use. Flexible packaging prevents oxygen and moisture ingress, which reduces spoilage. Aerospace industries use films for insulation and cryogenic applications. Electronics rely on metalized PET for electrical conductivity and shielding. The films’ strength and heat resistance (some withstanding above 200°C) make them versatile.

Which Companies Are Recognized as Global Leaders in Metalized PET Films Manufacturing?

The global leaders in metalized PET films come from diverse regions and industries. Key manufacturers include:

| Manufacturer | Headquarters | Notes |

|---|---|---|

| Toray Plastics (America) | USA | Focus on innovative, high-quality PET films |

| Uflex Ltd. | India | Large producer with range including BOPP, BOPET |

| Jindal Poly Films | India | Seventh largest polyester film producer globally |

| Mitsubishi Polyester Film | Japan | Pioneer with strong technology and product range |

| SRF Limited | India | Specializes in packaging and technical films |

| Futamura Chemical | Japan | Focus on biodegradable and sustainable films |

| RETAL Industries | Europe | Known for high-performance packaging films |

| DuPont Teijin Films | Global | Leading in innovation and film diversification |

These companies are recognized for large production capacities, quality control, and strong research investments. Their presence spans Asia, North America, and Europe, reflecting metalized PET’s global demand.

What Regions and Countries Are Home to the Top Producers of Metalized PET Films?

Asia dominates the production landscape, especially India, Japan, and China. India is home to Uflex Ltd., Jindal Poly Films, and SRF Limited, all significant players in the global market. Japan hosts Mitsubishi Polyester Film and Futamura Chemical, companies with advanced production technology and sustainability initiatives.

North America has strong representation through Toray Plastics, known for innovative packaging solutions. Europe includes RETAL Industries and DuPont Teijin Films, focusing on specialty films with high tech and eco-friendly properties.

Together, these regions cover a vast share of the market, supported by strong industrial bases and supply chains.

How Do Companies Like Toray Plastics (America), Uflex Ltd., Jindal Poly Films, and Mitsubishi Polyester Film Compare in Product Offerings and Scale?

| Company | Product Range | Scale & Reach | Specialties |

|---|---|---|---|

| Toray Plastics (America) | BOPET, PVDC PET, CeramAlOx® PET, specialized metal coatings | Large-scale US and global distribution | High-tech films with advanced coatings |

| Uflex Ltd. | BOPET, BOPP, Blown PP/PE, CPP films | Global with focus on India and Asia | Flexible packaging and industrial films |

| Jindal Poly Films | BOPET and metalized polyester films | 7th largest polyester film maker | Strong export market, flexible packaging |

| Mitsubishi Polyester Film | Wide variety of polyester films including metalized | Global leader with vast production | Innovation in sustainability and film tech |

Toray excels in premium product innovation, focusing on durability and metal adhesion. Uflex and Jindal concentrate more on volume and product variety, serving packaging and industrial sectors. Mitsubishi is noted for its technology advancement and sustainability efforts, producing high-end films used in various fields.

What Certifications and Standards Do Leading Manufacturers Adhere to Ensure Quality and Reliability?

To maintain product excellence, leading manufacturers comply with key certifications and quality standards, including:

- ISO 9001:2015 – Quality management systems ensuring consistency.

- ASTM Standards – Such as ASTM F-1249 for moisture vapor transmission rate (MVTR) and ASTM D-3985 for oxygen transmission rate (OTR).

- REACH Compliance – Meets European chemical regulation standards for chemical safety.

- FDA Compliance – For food-grade films used in packaging consuming products.

- RoHS Directive – Restricts hazardous substances in electronics applications.

These certifications guarantee uniform metal deposition, consistent thickness, and safe, reliable films for sensitive applications.

How Does the Manufacturing Capacity and Technology Sophistication Differ Among Leading Producers?

Manufacturing capacity varies widely. Large producers like Toray and Mitsubishi operate high-volume, technologically advanced plants capable of producing thousands of tons annually. These facilities use state-of-the-art metallization technologies such as vacuum deposition systems and uniform metal layering to ensure product uniformity.

Mid-tier producers like Uflex and Jindal focus on both volume and customization, with multiple plants catering to regional markets. Their technology supports functional coatings, multiple substrate types, and eco-friendly film options.

Advanced technology also means companies can handle high-temperature films, specialty coatings (like copper or ceramic metals), and sophisticated printing or surface treatments for enhanced adhesion and aesthetics.

What Role Do Customization and Specialized Metal Coatings Play in Differentiating These Manufacturers?

Customization is a major selling point for metalized PET film manufacturers. Clients often need films tailored for specific barrier properties, thickness, conductivity, or appearance.

Specialized metal coatings (aluminum, copper, other metals) vary in thickness and density, impacting electrical resistivity and optical density. For example:

| Metal Coating | Electrical Resistivity (Ω/sq) | Application Example |

|---|---|---|

| Aluminum | ~1.80 | Flexible packaging, decoration |

| Copper | ~0.80 | Electronics, conductive films |

Leading manufacturers offer choices in substrate type, metal layer thickness, and surface treatments. This flexibility lets clients meet specific packaging or industrial requirements.

Customization also means choices in barrier ratings — some films achieve MVTR <0.002 g/m²/day and OTR <2 cc/m²/day, key for sensitive goods. Customized films may have enhanced heat deflection (resistance above 200°C) or improved metal adhesion for long-term use.

Metalized PET films are a vital material in many industries. To identify leading manufacturers of metalized PET films, one must look at companies combining capacity, certification, innovation, and customization. Toray Plastics, Uflex Ltd., Jindal Poly Films, and Mitsubishi Polyester Film stand out as global leaders. They illustrate how regions like Asia, North America, and Europe contribute to a complex, evolving market driven by technical quality and design flexibility.

What Technical Features and Product Ranges Do Top Metalized PET Film Manufacturers Offer?

When you want to identify leading manufacturers of metalized PET films, understanding their technical features and product range is key. These give you insight into the quality, usability, and innovation level of their offerings. Top producers focus on substrates, precision metal coatings, barrier properties, and special applications. Let’s break this down.

Common Substrates and Film Types in Metalized PET Films

The choice of substrate impacts strength, clarity, and barrier effects. Most metalized PET films start with BOPET (Biaxially Oriented Polyethylene Terephthalate). BOPET provides excellent tensile strength, dimensional stability, and heat resistance. Its thickness can vary from 8 to 50 microns depending on application needs.

Other notable substrates include:

- PVDC PET: Polyvinylidene Chloride coated PET, offering improved moisture and oxygen barriers.

- CeramAlOx® PET: A ceramic-like coating on PET that enhances gas barrier properties without using metals.

- BOPP, BON, LDPE: Used less often but sometimes combined with metallized PET for multi-layer films.

These substrates are chosen based on the required barrier level, clarity, and durability. For example, CeramAlOx® is more suitable where metal adhesion or recycling is challenging.

Typical Thickness and Metal Layer Optical Densities

Thickness directly influences film strength and barrier performance. Leading manufacturers produce metalized PET films in a broad thickness range of 8 to 50 microns.

The metal coating layer usually involves aluminum or copper. Thickness here is ultra-thin, often less than 100 nanometers but enough to provide a metal layer with optical density values ranging from 0.18 to 4.50. Optical density reflects the film's ability to block light and protect contents.

| Film Property | Typical Range |

|---|---|

| Film Thickness | 8 – 50 microns |

| Metal Layer Optical Density | 0.18 – 4.50 |

| Electrical Resistivity | Al-coated: ~1.80 Ω/sq |

| Cu-coated: ~0.80 Ω/sq |

Lower resistivity is vital for films used in electronic or shielding applications. Aluminum coatings are the most common due to cost-effectiveness and good barrier properties. Copper coatings appear more in conductive films.

Impact of MVTR, OTR, and Electrical Resistivity on Performance

Moisture Vapor Transmission Rate (MVTR) and Oxygen Transmission Rate (OTR) are critical performance indicators in packaging and industrial films.

- MVTR measures moisture penetration. Leading films boast MVTR values below 0.002 g/m²/day (per ASTM F-1249). This excellent moisture barrier prevents spoilage in food and maintains chemical product integrity.

- OTR measures oxygen passage. Top products offer OTR < 2 cc/m²/day (ASTM D-3985), crucial for sensitive products like pharmaceuticals and snacks.

- Electrical Resistivity determines conductivity. Films with low resistivity (0.8–1.8 Ω/sq) serve applications in electronics, EMI shielding, and sensors.

These properties matter because even small changes can affect shelf life, product quality, or device function.

Key Barrier Properties and Their Importance

Metalized PET films provide multiple barrier properties essential to packaging and industrial uses:

- Gas Barrier: Stops oxygen and other gases from reaching contents.

- Moisture Barrier: Prevents water vapor from passing through film.

- Light Barrier: Protects light-sensitive products using high metallization.

- Heat Resistance: Supports heat sealing and stable storage.

These barriers help maintain freshness, prevent odor migration, and protect electronic parts against humidity. In industrial use, they support thermal insulation and protect sensitive materials.

High-Temperature Resistance and Specialized Applications

Some manufacturers produce films with high-temperature resistance above 200°C. This allows use in:

- Aerospace: Parts insulation and cryogenic systems.

- Medical: Sterilizable packaging and device layers.

- Electronics: Flexible circuits and pulse power devices.

Such films retain strength and barrier properties at elevated temps. For example, films for aerospace need combined metal adhesion and physical durability under extreme stress.

Innovations in Metal Adhesion, Uniform Metallization, and Eco-Friendly Formulations

Top manufacturers are pushing boundaries with:

- Advanced Metal Adhesion: Tech that ensures metal sticks strongly, preventing flaking or delamination. Uniform coating thickness improves optical density and barriers.

- Eco-Friendly Coatings: New bio-based and biodegradable metal coatings reduce environmental impact. These include water-based metallizing or low-energy vacuum deposition techniques.

- Uniform Metallization: Automated optical sensors ensure precise and even metal layers, crucial for consistent film performance.

- Sustainability Drives: Use of recycled PET and post-consumer resin helps manufacturers lower carbon footprints.

These innovations directly address customer demand for better performance and greener products.

Customization Options and Their Effects on Performance and Cost

Customization allows film makers to tailor thickness, metal type, barrier level, and surface treatments. These choices influence:

| Factor | Effect on Performance | Effect on Cost |

|---|---|---|

| Film Thickness | Improves strength and barrier | Increases material cost |

| Metal Type (Al vs. Cu) | Alters conductivity and barrier | Copper costs more |

| Barrier Coatings (PVDC, CeramAlOx®) | Enhances gas/moisture resistance | Raises process cost |

| Surface Treatments | Improves printability and adhesion | Slightly increases cost |

Customized films meet exact needs for packaging or industrial uses but usually cost more than standard films. Still, the benefits in shelf life, product safety, or device performance often justify the price.

Technical Standards Defining Quality Metalized PET Films

Quality is measured against clear standards such as:

- ISO 9001:2015: Ensures consistent quality management.

- ASTM F-1249 and D-3985: Define MVTR and OTR testing methods.

- UL certifications: For electrical and fire safety in specialty films.

Meeting these standards ensures films perform as promised and regulators accept them in critical applications like food and medical packaging.

How Different Metal Coatings Affect Film Properties and Uses

- Aluminum: Most common, low-cost, excellent barrier and reflectivity.

- Copper: Better electrical conductivity, suited for electronics.

- Silver or Nickel: Special uses involving anti-microbial or corrosion resistance.

Choice depends on application, budget, and performance needs.

Emerging Innovations from Top Manufacturers

The latest trends focus on:

- Hybrid Coatings: Combining metals with ceramic layers for enhanced barrier and toughness.

- Nanocoatings: Using nanotechnology to reduce metal thickness while boosting barrier.

- Recyclable Metallized Films: Designing films easy to separate metal from substrate for recycling.

- Smart Films: Incorporating sensors or conductive paths in films for IoT and smart packaging.

These innovations come from heavy R&D investments. Leaders like Toray Plastics, Uflex Ltd., and Mitsubishi Polyester Film constantly evolve product portfolios to stay ahead.

If you want to select a supplier or understand quality metalized PET films, consider these technical features and product ranges carefully. They reveal a manufacturer’s capability and suitability for your industry needs.

How Does the Market Landscape Influence Choosing a Metalized PET Film Manufacturer?

Understanding the metalized PET films market is key when you want to identify leading manufacturers of metalized PET films. The market landscape shapes how you pick a supplier. Let’s dive deep into the major drivers, challenges, regional trends, sustainability efforts, value chains, pricing, and future growth in this sector.

Major Market Drivers and Challenges Influencing the Metalized PET Films Industry Globally

The metalized PET films market has grown due to rising demand from flexible packaging, electronics, and medical industries. Consumers want longer shelf life, better product protection, and attractive packaging designs, which metalized PET films deliver through their excellent barrier properties against moisture, oxygen, and light. The films also play a key role in aerospace and renewable energy sectors due to their heat resistance and electrical conductivity.

However, this market faces hurdles such as the rising cost of raw materials like PET and aluminum for metallization. Handling and delamination risks can increase waste and costs. Environmental concerns have led to regulatory pressure to improve recyclability and develop biodegradable films. Innovation and cost control remain constant challenges for manufacturers worldwide.

How Market Shares and Revenue Data Help Identify Leading Manufacturers

Market shares and revenue figures give a clear picture of who leads the metalized PET films market. Top players like Toray Plastics (America), Mitsubishi Polyester Film (Japan), Uflex Ltd., and Jindal Poly Films (India) show strong sales and wide geographic reach.

| Manufacturer | Region | Estimated Revenue Share (%) | Key Strengths |

|---|---|---|---|

| Toray Plastics | Americas | ~15% | Advanced tech, customized films |

| Mitsubishi Polyester | Asia | ~14% | High-volume, innovation leader |

| Uflex Ltd. | Asia | ~10% | Diverse products, eco-focus |

| Jindal Poly Films | Asia | ~8% | Cost-effective solutions |

Revenue trends highlight companies investing in sustainability and advanced technologies, helping you spot manufacturers ready for future demands.

Regional Market Trends Affecting Supply, Demand, and Innovation

The market varies widely by region due to local demand, raw materials, and technology.

- Asia: Home to growing production hubs in India, China, and Japan. Rapid urbanization drives demand in food packaging and electronics. Manufacturers invest heavily in recycling and biodegradable films here. India alone accounts for about 8% of the global metalized PET films market by value.

- Europe: Focuses on sustainability and strict environmental regulations. Producers here often lead innovation in bio-based films and recycled-content materials. The market favors premium quality and certified production processes (ISO 9001:2015).

- Americas: Strong demand from flexible packaging for beverages and pharma; innovation often focuses on new barrier coatings and electrical properties for electronics and renewable energy applications.

Demand in each region affects availability and pricing. For example, Europe's eco-sensitive market may come with higher prices but better sustainability.

Balancing Sustainability Efforts with Production Costs

Manufacturers are under growing pressure to reduce environmental impact. Many are:

- Increasing use of recycled PET content.

- Developing biodegradable films, e.g., bio-based coatings.

- Reducing packaging weight to lower carbon footprint.

However, recycled and biodegradable films often cost more due to limited raw material supply and processing challenges. Producers must balance eco-friendly goals with production costs, while maintaining product quality and barrier performance.

For instance, Toray Plastics focuses on renewability using bio-based materials and strategic programs to improve sustainability. Uflex Ltd. prioritizes reduction of plastic waste and invests in greener solutions without sacrificing affordability.

The Metalized PET Films Value Chain from Raw Materials to End-Users

Understanding the value chain helps when choosing a manufacturer:

| Stage | Description |

|---|---|

| Raw Material Suppliers | PET resin, aluminum, and other coating suppliers |

| Film Manufacturers | Produce base films like BOPET and metallize films |

| Converters | Create finished products like laminated packaging |

| Distributors | Manage logistics and sales |

| End-Users | Food & beverage, medical, electronics, aerospace |

Quality and cost considerations at each step impact the final film. Manufacturers with strong supply chain control often offer better reliability and innovation capability.

Pricing, Profitability, and Quality Differences Across Regions and Manufacturers

Pricing depends on film thickness, metallization density, customization, and certifications. For example:

- In India, metalized polyester films range from INR 150 to INR 300 per kilogram, influenced by gauge and metal layer thickness.

- High-end films with advanced barrier properties or biodegradable content cost more globally.

Profit margins vary by scale and region. Large manufacturers with automated lines and in-house raw material sourcing, like Mitsubishi Polyester, enjoy better profitability. Smaller or regional producers compete on price and niche specialization.

Quality standards like uniform metallization, metal adhesion, and certified production (ISO 9001:2015) distinguish top manufacturers. Consistent quality is essential, especially for food and pharma packaging.

Future Growth Prospects and How Top Companies Are Preparing

The global metalized PET films market is projected to grow at a strong CAGR until 2028. Growth drivers include:

- Increasing demand for sustainable packaging.

- Expanding electronics and aerospace applications.

- Innovation in barrier coatings and electrical conductivity.

Leading companies prepare by:

- Investing in R&D for eco-friendly films with high performance.

- Forming strategic partnerships to improve recycling technologies.

- Expanding production capacity in high-growth regions such as Asia.

- Enhancing customization options for different industry needs.

For example, DuPont Teijin Films works on bio-based PET films and focuses on energy-efficient production. RETAL Industries develops coatings that improve recyclability while maintaining barrier features.

Market Factors to Consider When Selecting a Metalized PET Film Manufacturer

When choosing a manufacturer, consider:

- Technical ability: Can they meet your film thickness and barrier requirements?

- Certification: Do they hold quality standards like ISO 9001:2015?

- Sustainability: Are they developing recycled or biodegradable options?

- Regional proximity: To reduce shipping time and costs.

- Customization: Ability to tailor films to your needs.

- Financial stability: Strong market shares indicate reliability.

How Sustainability Trends Influence Manufacturer Offerings

Most top suppliers now offer films with recycled content. They also focus on:

- Reducing carbon footprint: Lightweight packaging.

- Developing biodegradable films: Though still niche and slightly more expensive.

- Innovating coatings: To allow easier recycling and less contamination.

These trends affect product availability and choice and are increasingly demanded by global brands.

Regional Differences Affecting Manufacturer Selection and Availability

- Asia: Offers cost-competitive options with growing eco-friendly products.

- Europe: Best for premium, certified, and super-eco films.

- Americas: Strong in innovation and broad industry applications.

Your choice depends on your product’s market, budget, and sustainability goals. Knowing these regional trends helps narrow down which manufacturers will serve you best.

Navigating the complex market landscape for metalized PET films requires a deep understanding of industry drivers, regional differences, and sustainability trends. Keeping these factors in mind lets you identify leading manufacturers who align best with your needs.

Bonus Table: Summary of Market Shares and Regional Strengths

| Region | Leading Manufacturers | Market Share Approx. | Key Focus |

|---|---|---|---|

| Asia | Uflex Ltd., Jindal Poly Films, Mitsubishi Polyester Film | 30%+ | Volume, eco-innovation |

| Europe | RETAL Industries, DuPont Teijin Films | ~20% | Sustainability, certifications |

| Americas | Toray Plastics (America) | ~15% | Advanced tech and customization |

| Global | Others | Remaining | Specialized, niche products |

Visual Table of Key Technical Features and Product Ranges

| Feature | Details/Range | Impact |

|---|---|---|

| Substrate | BOPET, PVDC PET, CeramAlOx®, BOPP, BON, LDPE | Strength, clarity, barrier properties |

| Film Thickness | 8 – 50 microns | Mechanical strength, barrier |

| Metal Coatings | Aluminum (cost-effective), Copper (conductive) | Barrier, electrical conductivity |

| MVTR | < 0.002 g/m²/day (ASTM F-1249) | Moisture barrier performance |

| OTR | < 2 cc/m²/day (ASTM D-3985) | Oxygen barrier performance |

| Heat Resistance | Up to > 200°C | High-temp applications (aerospace, medical) |

| Certifications | ISO 9001:2015, ASTM, REACH, FDA, RoHS | Quality and safety compliance |

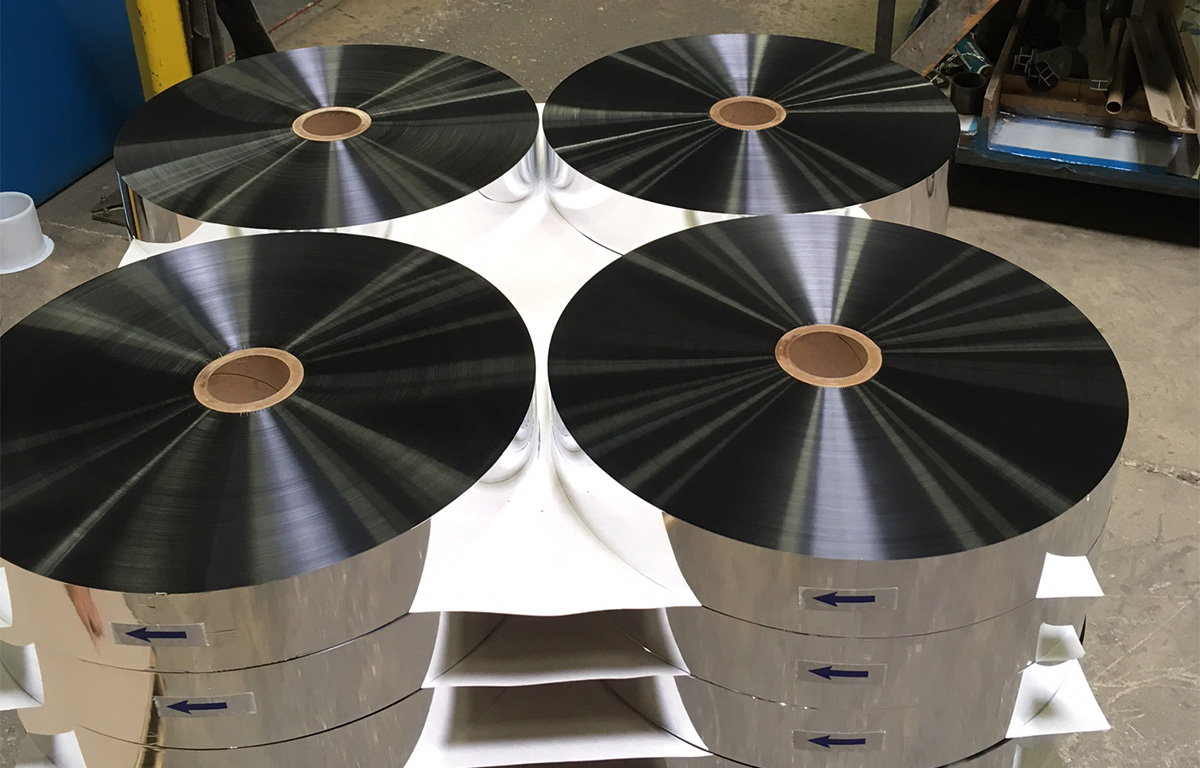

Image for Final Section: Application and Innovation

This completes the blog with images inserted after each main H2 heading and with relevant tables included throughout for enhanced visualization and understanding of key data points.

FAQs about Identify leading manufacturers of metalized PET films

Who are the leading manufacturers of metalized PET films globally?

The leading manufacturers of metalized PET films globally include Toray Plastics (America), Uflex Ltd., Jindal Poly Films, Mitsubishi Polyester Film, SRF Limited, Futamura Chemical, RETAL Industries, and DuPont Teijin Films, recognized for their production capacity, quality, and innovation across Asia, North America, and Europe.

What are metalized PET films and why is their manufacturing significant?

Metalized PET films are polyethylene terephthalate substrates coated with a thin metal layer that provides excellent barrier properties, crucial for extending product shelf life, protecting electronics, enhancing insulation, and improving energy efficiency in various applications.

How do metal coatings and film thickness affect metalized PET film performance?

Metal coatings like aluminum and copper, combined with film thickness ranging from 8 to 50 microns, determine barrier strength, electrical resistivity, and optical density, directly influencing moisture and oxygen blocking, conductivity, and suitability for packaging or electronic uses.

What certifications do leading manufacturers comply with to ensure quality and safety?

Leading manufacturers comply with certifications such as ISO 9001:2015, ASTM standards for moisture and oxygen transmission, REACH, FDA for food safety, and RoHS to ensure consistent quality, chemical safety, and suitability for sensitive applications.

How do customization and specialized metal coatings differentiate metalized PET film manufacturers?

In this article, I have summarized the key players in metalized PET film manufacturing worldwide. We covered their product types, technology levels, and quality standards. I also looked at market trends and how regions shape the industry. Understanding these factors helps you pick the right manufacturer for your needs. The future of metalized PET films relies on innovation and sustainability. Stay informed and choose partners that match your priorities and quality expectations.