What Are the Key Future Trends Influencing Metalized Film Manufacturing?

The future of metalized film manufacturing is exciting and fast-changing. New technologies and smart production methods are reshaping this industry. Let’s explore the main trends that will affect metalized film manufacturing in the coming years. These trends cover new tech, materials, automation, and market growth, helping you understand what’s ahead.

What Technological Advancements Are Shaping the Future of Metalized Film Manufacturing?

Technology plays a big role in making metalized films better, faster, and cheaper. One major leap is in the vacuum metallization process, where a thin metal layer (usually aluminum, about 20-100 nm thick) is deposited on polymer films at very low pressures (10^-5 to 10^-6 torr). Modern vacuum lines can run over 1,000 meters per minute, improving throughput by 40% and cutting energy use by 25% compared to early 2000s.

New coating methods like plasma-enhanced deposition and controlled atmosphere pretreatment help improve metal adhesion and film consistency. These techniques clean and activate the film surface, allowing metals to stick better. This leads to films with stronger barrier properties, longer shelf life, and better look.

How Are Plasma-Enhanced Deposition and Controlled Atmosphere Pretreatment Evolving Production Lines?

Plasma-enhanced deposition uses ionized gases to prepare the film surface before metal application. This step improves how metals bond to the films, leading to stronger barriers and less metal needed. It also cuts defects by ensuring uniform metal layers.

Controlled atmosphere pretreatment means films are processed in carefully regulated gases that prevent contamination and oxidization. This helps keep metal layers pure and consistent. These two advancements enable higher-quality films and reduce waste on production lines.

What Role Do Automation and AI Integration Play in Increasing Manufacturing Efficiency and Quality Control?

Automation is transforming metalized film plants. Robots and sensors now monitor film thickness, metal layer uniformity, and surface defects in real time. AI systems analyze this data to predict faults and optimize machine settings on the fly.

By using AI, manufacturers improve yield rates and cut downtime. Machines adjust metal deposition parameters without human intervention, leading to consistent product quality. Smart systems also help meet strict tolerances required for industrial uses like electronics and solar control, where precision is key.

How Is Vacuum Metallization Technology Improving Throughput and Energy Consumption?

Vacuum metallization dominates (~95%) metalized film production due to its quality and cost-effectiveness. New vacuum chambers use energy-efficient pumps and improved heat recovery to reduce power waste by up to 25%.

Besides energy gains, modern lines can handle wider film widths (>2 meters) and run faster speeds (up to 1,000 m/min). This increases production volume and lowers cost per square meter of film. Faster production means quicker market supply and new application chances.

What Material Science Innovations Like Thinner Substrates and Reduced Metal Thickness Are Emerging?

Materials research is key to greener, cheaper films. New polymers allow thinner substrates without losing strength or clarity. This downgauging lowers raw material use and weight, cutting carbon footprints by 15-30%.

In parallel, metal layer thickness drops by 30-50%. Manufacturers use plasma and vacuum tech to control ultra-thin metal films, still achieving high barrier properties against oxygen and moisture. Thinner metal plus thin films reduce overall resource use, meeting eco-friendly goals.

Table: Material Innovation Benefits

| Innovation | Impact |

|---|---|

| Thinner polymer substrates | Lower material cost and weight |

| Reduced metal thickness | Saves metal and energy, cuts emissions |

| Advanced polymers | Maintains strength, clarity |

How Do Advanced Pattern Metallization and Multi-Layer Coatings Affect Performance and Customization?

New patterning techniques enable designs instead of solid metal films. This means manufacturers can create stripes, grids, or dots on films. These patterns tune light reflection, improve flexibility, and allow packaging with interactive designs.

Multi-layer coatings stack metal with polymers or oxides for enhanced protection. For example, layers can block UV rays, heat, or gases more effectively than single metal coats. These options offer greater film customization depending on the application, such as food packaging or electronics insulation.

What Are the Projections for Market Growth and Key Geographic Regions Leading Demand?

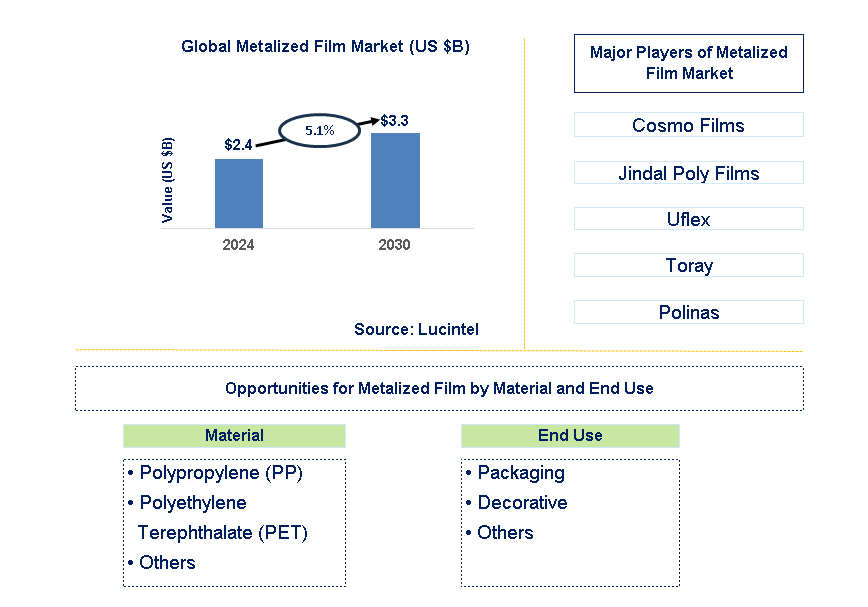

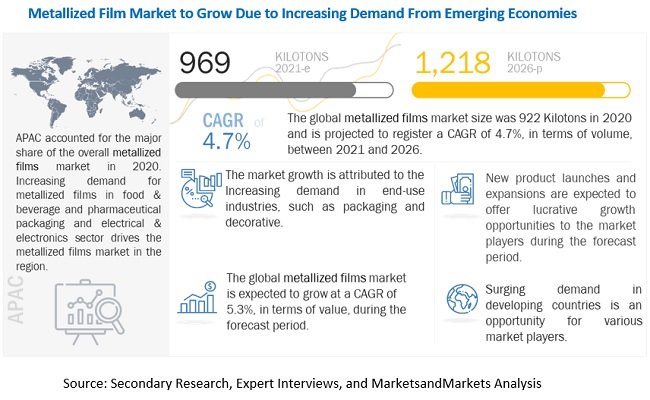

The metalized films market is growing steadily. In 2023, it was valued at $2.27 billion, with forecasts expecting it to reach $3.14 billion by 2028 at a CAGR of 4.7%. Flexible packaging leads usage at 58% of total consumption.

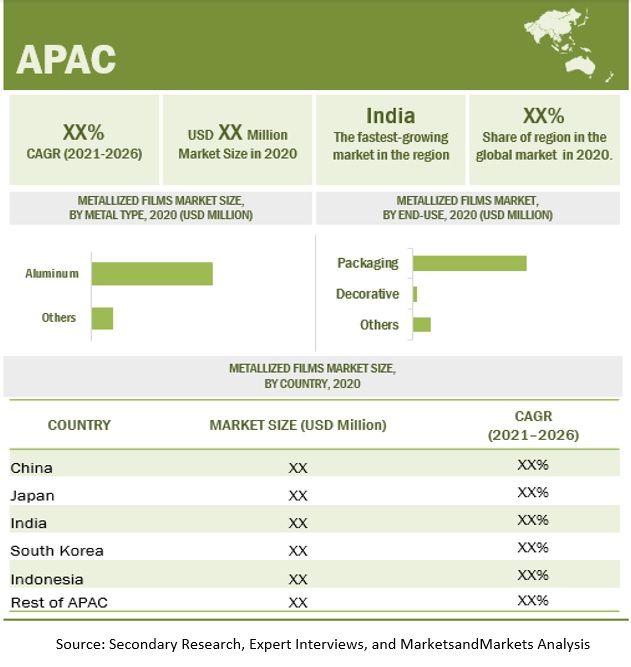

Asia-Pacific dominates with 42% market share, mainly China, Japan, and South Korea. This region has booming food packaging needs and industrial use, driving rapid growth. North America and Europe emphasize innovation and sustainability, influencing eco-friendly metalized films.

Projected market drivers:

- Food packaging: Barrier films extend shelf life 2-5 times via 98-99.5% oxygen reduction.

- Industrial uses: Electronics, insulation, requiring precise quality.

- Decorative goods: Adding aesthetics with holographic and metallic effects.

| Region | Market Share 2023 | Expected Growth Rate |

|---|---|---|

| Asia-Pacific | 42% | 5-6% CAGR |

| North America | 25% | 3-4% CAGR |

| Europe | 20% | 3% CAGR |

| Others | 13% | 3-5% CAGR |

Today, innovations in metalized film manufacturing focus on making films greener, stronger, and smarter. With plasma technologies and AI-driven automation, production lines are more efficient and produce finer films. Vacuum metallization improves throughput, while thinner materials and new coatings boost performance and cut waste. The Asia-Pacific region is the hotbed for growth, driven by packaging and industrial demand. If you want a peek into where this industry is heading, these are the key trends to watch.

How Are Sustainability and Environmental Trends Impacting Metalized Film Manufacturing?

The metalized film industry is changing fast because of sustainability and environmental concerns. As a maker or user of metalized films, you need to understand these shifts well. Let’s examine future trends influencing metalized film manufacturing, focusing on eco-friendly moves, challenges, and advances shaping the market and practices.

Sustainability Challenges in Metalized Film Production and Use

Metalized film combines polymers like PET or PP with ultra-thin aluminum layers (20-100 nm). This mix creates excellent barrier properties but also poses recycling and environmental challenges. The main issues include:

- Complex Recycling: The thin metal layer bonded to polymer films makes separation hard. Recycling metalized films with standard plastic streams often fails.

- Raw Material Use: Aluminum coating requires energy-intensive vacuum metallization. Polymer substrates rely on petroleum-based materials.

- Disposal Concerns: Metalized films persist long in landfills if not properly recycled or composted.

- Emission Footprint: Traditional production involves high carbon emissions and energy consumption.

Overcoming these challenges is key to making metalized films greener.

Manufacturers Cut Carbon Footprints with Downgauging and Metal Thickness Reduction

One major future trend is making films thinner without losing performance. Downgauging means using thinner substrates; metal thickness reduction means applying less aluminum. This lowers raw material use, carbon emissions, and energy demand.

- Recent advances allow cutting metal layers by 30-50%, saving 15-30% of carbon footprint in production.

- PET and BOPP films are now produced down to 12-15 microns while still meeting barrier standards.

- These lightweight films also reduce transportation emissions due to lower mass.

Downgauging helps companies meet sustainability targets and cut costs. It also aligns with customer demands for eco-friendly packaging.

Recycling Technology Advances: Delamination and Metal Recovery

A big problem with metalized films is recycling due to the fused metal layer. But new delamination technologies solve this by separating the metal coating from the polymer. Key advances include:

| Technology Aspect | Details |

|---|---|

| Delamination Systems | Mechanical/chemical processes break down films to separate metal and plastic layers. |

| Metal Recovery Efficiency | Up to 90% aluminum can be recovered and reused, lowering raw metal demand. |

| Polymer Reuse | Clean polymer films recovered for remanufacturing packaging or other products. |

| Integration in Sorting Facilities | Emerging optical sorting tech helps identify metallized films at recycling centers. |

These technologies reduce landfill waste and improve circularity. Companies like Uflex and ProAmpac are leading recycling pilots to boost metalized film recyclability.

Biodegradable and Compostable Alternatives Impacting the Market

The rise of biodegradable metalized films is reshaping the landscape, especially in markets seeking zero-waste solutions. For example:

- India’s Pakka Flexible Packaging launched its first bio flexible packaging in October 2023.

- This product combines compostable biopolymers with metal-like barrier layers using bio-based aluminum alternatives.

- Biodegradable films break down within months, unlike traditional polymers.

- These options suit food packaging seeking lower environmental footprints without losing shelf life.

- Market analysts expect bio flexible packaging demand to grow 15-20% annually through 2030.

While still niche and costlier, these alternatives provide exciting paths for future green packaging.

Regulations and Environmental Standards Shaping Manufacturing Practices

Governments worldwide are tightening rules on sustainable packaging, directly impacting metalized film production. Some key factors:

- Extended Producer Responsibility (EPR): Manufacturers must manage packaging waste collection and recycling.

- Bans on Non-Recyclable Platics: Some regions limit or ban non-recyclable metalized films.

- Carbon Emission Targets: Factories must reduce energy use and greenhouse gas emissions.

- ISO 14001 and Eco-Labels: Companies seek environmental certifications to prove green credentials.

- Food Safety Compliance: New standards require migration limits for metals in food packaging, restricting some coatings.

These rules drive innovation and force manufacturers to adopt greener technology and materials.

Aligning Sustainable Practices with Consumer Demand and Brand Expectations

Consumers want greener packaging. Big brands feel pressure to deliver sustainable products. Data shows:

- 72% of consumers prefer brands with eco-friendly packaging.

- 65% would pay more for recyclable or compostable options.

- Brands using metalized films can promote extended shelf life as well as sustainability.

- Transparency about carbon footprints and recyclability builds trust.

- Sustainability has become a key buying criterion for millennials and Gen Z shoppers.

For manufacturers and brands, embracing eco-friendly metalized films improves market positioning and loyalty.

Case Studies of Successful Green Manufacturing

Some firms have set good examples in sustainable metalized film manufacturing:

| Company | Initiative | Outcome |

|---|---|---|

| Cosmo Films | Launched metalized BOPP films with 30% less metal. | Reduced CO2 emissions by 20%, boosted recyclability. |

| ProAmpac | Introduced easy-peel recyclable films in 2023. | Improved recycling rates, enhanced customer satisfaction. |

| Uflex Ltd | Developed proprietary delamination tech for aluminum recovery. | Reduced landfill waste, lowered raw material costs. |

| Pakka Limited (India) | First bio flexible packaging on metalized film base. | Created compostable packages with good barrier and shelf life. |

These case studies highlight how future trends influencing metalized film manufacturing can succeed commercially while helping the planet.

In closing, sustainability is not just a trend; it drives deep changes in metalized films. Technologies like thinner films, better recycling, and bio-based options address tough challenges. Regulations support these changes, while consumers reward brands taking green action. The industry’s future lies in balancing performance with eco-friendliness to meet growing demands worldwide.

What Are the Emerging Applications and Market Drivers for Future Metalized Film Manufacturing?

The global metalized films market is growing fast, with a value of $2.27 billion in 2023. Experts expect it to reach $3.14 billion by 2028, rising at a 4.7% annual rate. Let's examine future trends influencing metalized film manufacturing by exploring key applications and market drivers.

Primary Sectors Driving Demand

Four main sectors fuel demand for metalized films:

- Food Packaging: This sector takes up 60% of flexible packaging consumption. Popular foods like snacks, coffee, meats, and confectionery use metalized films. Their barrier properties protect flavors and freshness.

- Industrial: Accounting for 22% of use, industries rely on metalized films for insulation, solar control, and electronics protection. These uses require exacting quality and tight tolerances.

- Decorative: About 12% of consumption is decorative packaging and consumer goods. Seasonal products and gift wraps often feature metalized films for shine and visual appeal.

- Electronics: Growing demand for sturdy, lightweight protective films in electronics fuels production. Metalized films shield products from moisture, light, and electromagnetic interference.

How Metalized Films Enhance Shelf Life in Food Packaging

Metalized films make food packaging stronger and longer-lasting. They significantly cut oxygen and moisture entry, which spoil food. Here are the facts:

| Parameter | Effect with Metalized Films |

|---|---|

| Oxygen transmission | Reduced by 98-99.5% |

| Moisture transmission (WVTR) | Less than 1.0 g/m²/day |

| Shelf life extension | 2 to 5 times longer |

| Light protection | Blocks damaging UV and visible rays |

This means chips stay crisp longer, coffee tastes fresh, and meats keep their color and texture. Metalized films prevent oxidation, microbial growth, and moisture loss.

Innovations in Barrier Properties for Pharmaceuticals, Cosmetics, and Electronics

Recent advances boost barrier strength for delicate goods:

- Pharmaceuticals: New metalized films block moisture and oxygen to keep medicines stable and safe. Films often combine with other coatings for controlled release and tamper evidence.

- Cosmetics: Metalized films add an air-tight seal to creams and lotions, extending shelf life. At the same time, films allow eye-catching prints to build brand appeal.

- Electronics: Films now block light, moisture, and radiofrequency interference. Manufacturers produce layers that block up to 95% of heat and shield devices from humidity and dust.

These innovations open new markets beyond food packaging.

Design Enhancements Shaping Consumer Appeal

Beyond protection, metalized films enhance the look and feel of products. Consumers love bright, shiny packaging that grabs attention on shelves.

- Holographic effects add shifting rainbow patterns that catch the eye.

- Digital printing allows vibrant, precise images and brand messages.

- Embossing and debossing create textures that feel premium.

- Windowed films offer a peek inside packaging without losing barrier protections.

Research shows packaging with these features can increase consumer engagement by up to 37%, driving sales.

Market Opportunities from Emerging Economies and Urbanization

Fast-growing economies in Asia, Africa, and Latin America provide huge potential. Rising urban populations demand more packaged goods, especially processed foods and pharmaceuticals.

- Increased disposable income fuels premium packaging.

- Growing food retail infrastructure requires advanced packaging for shelf life.

- Urban settings push demand for convenience packaging.

Asia-Pacific is the biggest market, holding 42% of global consumption, with China leading. Emerging markets in South Asia and Africa also present future growth hotspots.

Regional Market Dynamics

- Asia-Pacific: Largest share at 42%. Growth is led by industrial expansion, processed food demand, and tech advances. Major players include China, Japan, and South Korea.

- North America: Focuses on innovation and sustainability. Metalized films here incorporate eco-friendly materials and recycling efforts.

- Europe: Strong regulations push greener materials and recyclability. Packaging trends favor biodegradable films and high-value decorative uses.

Geography influences raw material availability, regulatory landscapes, and consumer preferences.

Challenges Impacting Market Growth

Several hurdles might affect metalized film manufacturing trends:

- Raw Material Costs: Prices for polymers and metals like aluminum fluctuate, raising production costs.

- Supply Chain Issues: Recent global events caused delays and shortages in substrates and metals.

- Talent Shortages: Skilled workers for advanced vacuum metallization and film processing are limited.

- Recycling Complexity: The metallized layer can complicate recycling streams.

Overcoming these challenges requires innovation and investment in technology and workforce training.

What Industries Are Increasing Demand for Metalized Films?

Industries showing strong growth in metalized film use include:

- Food and beverage packaging (60% of flexible packaging)

- Pharmaceuticals and healthcare products

- Cosmetics and personal care

- Electronics and solar panels

- Automotive and construction (insulation)

Each sector values metalized films for their barrier, lightweight, and design benefits.

How Do Metalized Films Improve Packaging Functionality?

Key functional improvements metalized films bring include:

- Superior barrier protection against oxygen, moisture, and light

- Extended shelf life of sensitive products

- Reduced product waste from spoilage

- Lightweight alternative to aluminum foils cutting transport costs

- Enhanced thermal insulation and radiofrequency shielding

- Ability to incorporate high-definition graphics and tactile effects

What Market Factors Will Influence the Future of Metalized Films?

Several factors will shape the market going forward:

| Factor | Impact on Metalized Film Market |

|---|---|

| Technological advances | Higher throughput, lower energy use, thin films |

| Sustainability trends | Demand for recyclable, biodegradable films |

| Emerging economies | Growth in urban consumption and industrial uses |

| Regulatory pressures | Stricter packaging and environmental standards |

| Raw material volatility | Potential for cost increase or supply constraints |

| Consumer preferences | Shift toward premium, functional, and eco-friendly packs |

Manufacturers who adapt well will lead the market.

In conclusion, metalized film applications are diverse and expanding. Food packaging remains the strongest driver, but industrial, decorative, and electronics uses show rapid growth. Innovations in barrier properties and design offer new possibilities. Emerging markets and urbanization create major opportunities, while regional dynamics and market challenges require strategic responses. As you explore metalized film manufacturing trends, these factors reveal where future value lies.

FAQs about Examine future trends influencing metalized film manufacturing.

What technological advancements are shaping the future of metalized film manufacturing?

Technological advancements shaping the future of metalized film manufacturing include improved vacuum metallization processes running over 1,000 meters per minute, plasma-enhanced deposition, and controlled atmosphere pretreatment, which enhance metal adhesion, film consistency, and energy efficiency.

How do plasma-enhanced deposition and controlled atmosphere pretreatment evolve production lines?

Plasma-enhanced deposition and controlled atmosphere pretreatment evolve production lines by using ionized gases and regulated environments to improve metal bonding, reduce defects, maintain metal purity, and enable higher-quality films with less waste.

What role do automation and AI integration play in increasing manufacturing efficiency and quality control?

Automation and AI integration increase manufacturing efficiency and quality control by monitoring film thickness and defects in real time, predicting faults, optimizing machine settings autonomously, and ensuring consistent product quality with minimal downtime.

How are sustainability and environmental trends impacting metalized film manufacturing?

Sustainability and environmental trends impact metalized film manufacturing through challenges like complex recycling, carbon footprint reduction via downgauging and metal thickness reduction, advances in delamination recycling technologies, biodegradable alternatives, tightening regulations, and increasing consumer demand for eco-friendly packaging.

What are the emerging applications and market drivers for future metalized film manufacturing?

Emerging applications and market drivers include food packaging that extends shelf life by reducing oxygen and moisture transmission, industrial uses requiring precise quality, decorative packaging for consumer appeal

We explored key trends shaping metalized film manufacturing’s future. From tech advances like plasma deposition and AI, to eco-friendly moves like thinner films and recycling, change is constant. New uses in food, pharma, and electronics boost demand worldwide. Challenges exist, but innovation and sustainability lead the way. The industry’s future looks strong and dynamic. Staying informed helps you grasp why metalized films matter now and ahead.