Who Are the Leading Manufacturers of Metalized PET Films and What Makes Them Stand Out?

Understanding who the leading manufacturers of metalized PET films are helps in grasping the industry's dynamics. These companies drive innovation, set quality standards, and influence global supply chains. Let's explore the global market landscape and get to know the top players.

Overview of the Global Metalized PET Film Market Landscape

The global market for metalized polyester (PET) films is growing fast. Industry estimates predict the BoPET (biaxially-oriented PET) film market to reach about USD 17.15 billion by 2025. Growth is driven largely by demand in packaging, electrical components, and automotive sectors.

Metalized PET films provide excellent barrier properties against gases, moisture, and light, making them ideal for food, pharmaceutical, and industrial packaging. Their flexibility, durability, and shiny metallic look also boost their use in consumer packaging and decorative laminates.

Asia-Pacific leads in production and consumption, with China and India showing rapid industry growth. This growth is fueled by expanding factories and increasing packaging requirements in both countries.

Profiles of Top Manufacturers of Metalized PET Films

Key players shaping this market include:

| Empresa | Headquarters | Notable Strengths | Market Presence |

|---|---|---|---|

| DuPont Teijin Films | USA/Japan | High tensile strength, advanced coatings | Americas, Asia, Europe |

| Mitsubishi Polyester Film | Japan | Tech innovation, sustainability efforts | Asia-Pacific, Global |

| SKC Co. | South Korea | Wide thickness range, quality surface finish | Asia-Pacific, Europe |

| Toray Plastics | Japan | Superior barrier films, R&D leader | Global |

| Jindal Poly Films | India | Cost-effective, growing capacity | Asia, Middle East |

DuPont Teijin Films

DuPont Teijin Films ranks among the top for its consistently high-quality metalized PET films. It offers films with enhanced barrier performance and excellent dimensional stability. Their films are widely used in food packaging, electronics, and solar energy sectors.

The company earned certifications such as ISO 9001 and holds industry awards for innovation. Their production sites spread across the USA, Europe, and Asia balance quality control with market responsiveness.

Mitsubishi Polyester Film

Mitsubishi leads in technological advances, focusing on surface treatments that boost printability and anti-block coatings to reduce film tackiness. Its film portfolio includes ultra-thin films down to nanometer thicknesses for high-tech applications.

Their eco-friendly production processes reflect in the company’s strategy to develop recyclable films. Mitsubishi’s strongholds lie in Japan and Southeast Asia, with growing capacity in China.

SKC Co.

SKC Co. delivers a variety of metalized PET films tailored for applications from packaging to electrical insulation. They emphasize producing films with high optical density metallization for superior barrier properties.

SKC’s reputation is solidified by ISO certifications and commitment to sustainable practice. Their facilities in South Korea and China lead supply for East Asian markets.

Toray Plastics

Toray is a pioneer in research-driven product innovation. Its Lumiflex® series is known for combining high reflectivity and thermal stability, ideal for solar and electronics industries.

Toray’s global reach includes production in Japan, the U.S., and China. It invests heavily in R&D, consistently ranking high for patents in polyester film technology.

Jindal Poly Films

Jindal Poly Films, based in India, is popular for cost-effective metalized PET films. Their focus is on expanding capacity with new plants in India, aiming to meet growing regional packaging demands.

They emphasize sustainability by using recyclable materials and have received awards for environment-friendly processes. Jindal is rapidly gaining market share in South Asia and the Middle East.

Key Product Specifications and Technological Strengths

Metalized PET films from top companies share common features:

- Espesor: Films range from a few microns (6-12 μm) to ultrathin nanometer scales for specialized uses.

- Propiedades de barrera: Effective protection against oxygen transmission (OTR) below 1 cc/m²/day in many cases.

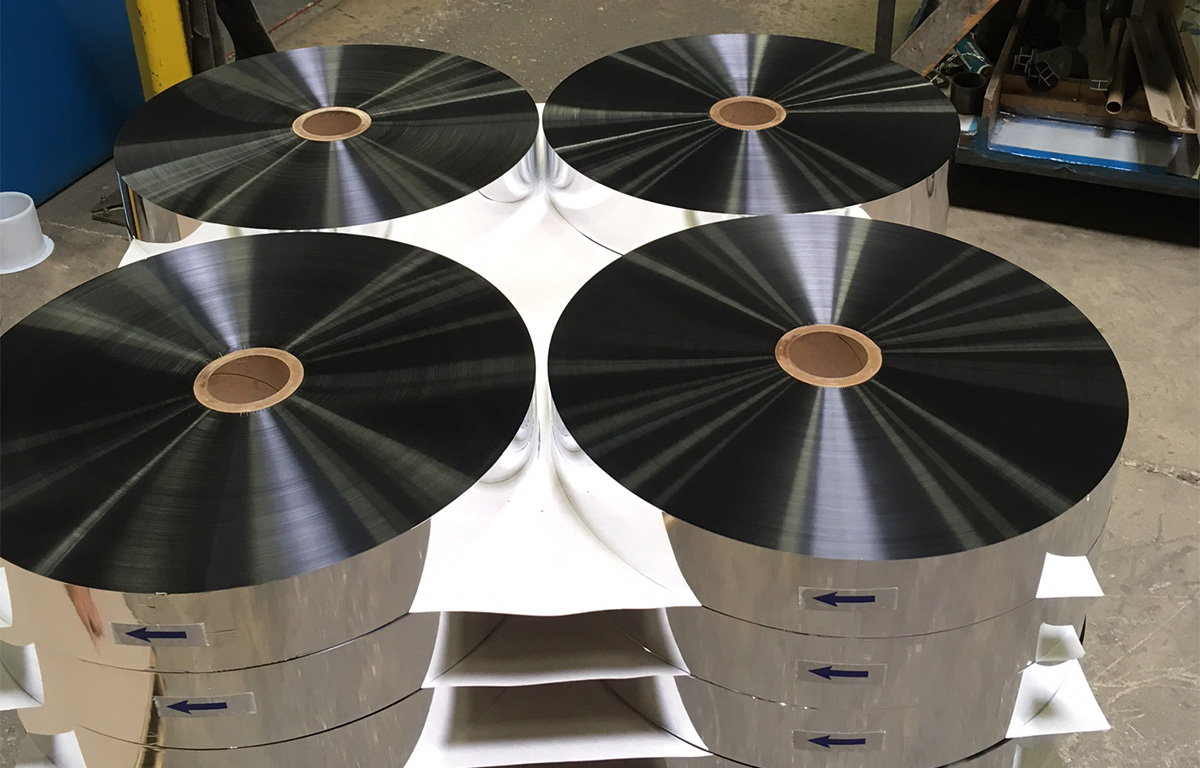

- Metal Layer: Usually a thin aluminum coating of 40-60 nm, ensuring reflectivity and moisture resistance.

- Surface Treatment: Coatings for printable surfaces, anti-static and anti-block layers to improve handling.

- Thermal Stability: Films withstand temperature ranges from -40°C to 150°C depending on grade.

Each manufacturer touts unique innovations. For instance, Toray’s Lumiflex® boasts exceptional light transmission for solar panel backing, while Mitsubishi advances nanocoatings that enhance metal adhesion.

Company Reputations, Certifications, and Industry Awards

Reputations stem from quality and sustainable manufacturing. Companies like DuPont Teijin Films and Toray Plastics hold:

- ISO 9001 quality management certification

- ISO 14001 environmental management accreditation

- Industry awards recognizing innovations, often for eco-friendly production or performance breakthroughs

These certifications demonstrate commitment to global standards. Awards further boost trust among end-users and business partners.

Geographic Distribution and Global Production Footprints

Asia-Pacific dominates production and demand, mainly led by:

- China: Rapid industrial expansion fuels high demand.

- India: Growing manufacturing base and packaging needs.

- Japan and South Korea: Focus on high-tech, high-value products.

Europe and North America serve niche, premium markets with specialized films.

Production plants are often strategically located near large customer clusters to reduce costs and improve supply chains. For example:

- DuPont Teijin Films runs plants across North America, Europe, and Asia.

- Mitsubishi and Toray maintain facilities in Japan, supplemented by sites in China and SE Asia.

- Jindal and SKC focus on expanding Indian and Korean manufacturing hubs respectively.

Market Share Overview and Comparative Revenue Estimates

Although exact revenue data is often proprietary, market research firms estimate:

| Empresa | Estimated Market Share (%) | Approximate Annual Revenue (USD Billion) |

|---|---|---|

| DuPont Teijin Films | 20-22 | 3.5 – 4.0 |

| Mitsubishi Polyester | 15-18 | 2.8 – 3.5 |

| SKC Co. | 10-12 | 1.5 – 2.0 |

| Toray Plastics | 12-14 | 2.0 – 2.5 |

| Jindal Poly Films | 8-10 | 1.2 – 1.5 |

These rankings reflect leadership but also highlight competitive pressure and new entrants advancing sustainable technologies.

Strategic Collaborations, Mergers, and Capacity Expansions

Leading manufacturers continuously invest to stay ahead.

- DuPont Teijin Films recently expanded capacity through collaborations with Asian converters.

- Mitsubishi Polyester Film acquired smaller metallizing firms to bolster its technology portfolio.

- SKC Co. modernized plants with new coating lines to enhance surface treatments.

- Toray Plastics invests consistently in R&D alliances for niche product development.

- Jindal Poly Films undertakes aggressive capacity expansion in India with greenfield plants.

These moves ensure their products remain competitive, innovative, and aligned with market demand.

Identifying the leading manufacturers of metalized PET films involves understanding their technology, global reach, and market strengths. DuPont Teijin, Mitsubishi, SKC, Toray, and Jindal each bring unique qualities that define current industry standards. From product innovation to sustainability focus, these companies shape metalized PET film markets worldwide.

What Are the Applications and Technological Innovations Driving Metalized PET Film Manufacturers?

Metalized PET films play a huge role in several industrial sectors thanks to their unique mix of strength, barrier protection, and versatility. These films come from BoPET (biaxially-oriented polyethylene terephthalate), widely favored for their tensile strength, chemical resistance, and excellent dimensional stability. Let’s look deeper into where these films are used and what new technologies are shaping their future.

Primary Industrial Applications of Metalized PET Films

Metalized PET film applications span across many fields, each demanding different levels of performance:

- Embalaje: This is the largest segment, making up over 50% of the market. Food, pharmaceuticals, and consumer goods benefit from metalized PET’s ability to protect contents from oxygen, moisture, and UV light. It replaces bulky aluminum foil for flexible packaging, keeping products fresh and attractive.

- Electrical Insulation: PET films are excellent insulators, resistant to heat and chemicals. Metalized layers improve shielding against electromagnetic interference in electronics, making them useful in capacitors, transformers, and wiring insulation.

- Automotive Components: Films serve various roles, from decorative trims to insulation and moisture barriers inside vehicles. Their durability and heat resistance meet the automotive industry's tough standards.

- Paneles solares: Films like Toray’s Lumiflex® series provide excellent light transmission and thermal stability. They serve as backsheet materials and protective layers, enhancing panel efficiency and lifespan.

These wide-ranging applications underline the versatility of metalized PET films.

Importance of Barrier Properties

The strength of metalized PET films lies largely in their barrier properties:

| Barrier Type | Role and Benefit |

|---|---|

| Oxygen | Prevents oxidation, prolonging shelf life |

| Moisture | Stops water vapor, maintaining product quality |

| Light | Shields sensitive contents from harmful UV and visible light |

The metallization layer, usually aluminum, gives these films a reflective finish that greatly boosts barrier effectiveness. Key factors include the uniformity of metallization and quality of metal adhesion. Better adhesion prevents peeling and enhances durability, critical for packaging that undergoes stress during transportation and storage.

Emerging Technological Advances in Metalized PET Films

The metalized PET film industry is undergoing remarkable innovations to meet changing market needs:

- Ultra-Thin Films: Metalized PET films have become thinner, sometimes down to just a few microns or nanometers, reducing material use and weight without sacrificing strength. Ultra-thin films help cut costs and support sustainability goals by minimizing plastic waste.

- Nano-Coatings: Manufacturers use advanced nano-coating techniques to add anti-static, anti-block, or antimicrobial properties. These coatings improve printability and handling while adding new functions.

- Surface Treatments for Printability: Specialized treatments enhance ink adhesion without damaging film integrity. This is key for brands needing vivid, long-lasting printed graphics in packaging.

- Innovations in Metal Adhesion and Uniformity: New deposition methods improve the evenness and bonding of the metal layer. This enhances barrier performance, thermal resistance, and aesthetic appeal. Uniform metallization also supports better recycling and reusability.

Development of Biodegradable and Recyclable Films

Sustainability is a powerful force reshaping the metalized PET film market. Leading manufacturers invest heavily in creating films that reduce environmental impact:

- Biodegradable Metalized PET Films: Companies are experimenting with bio-based PET sources and biodegradable coatings to minimize landfill waste.

- Recyclable Films: Innovations focus on removing or modifying metal layers so films remain easy to recycle alongside other plastics.

- Sustainability-Driven Product Lines: For instance, Uflex Ltd.’s ECOFLEX® range offers recyclable, environment-friendly films tailored for flexible packaging, reducing carbon footprint while maintaining performance.

- Toray's Lumiflex® series combines high barrier properties with eco-conscious production techniques, targeting growing clean energy and packaging markets.

Impact of Sustainability Requirements on Manufacturing

Sustainability shapes every stage of metalized PET film production today:

- Raw Materials: Many manufacturers increase use of recycled or bio-based resins.

- Production Processes: Firms implement energy-efficient coating and metallization methods to cut greenhouse gas emissions.

- Diseño de envases: Films are thinner and designed for easy separation and recycling.

- Circular Economy Strategies: Companies engage in take-back programs and partnerships to close the recycling loop.

This focus responds to rising regulatory demands worldwide and consumer pressure for greener products. Leaders like Amcor and Mondi invest in such solutions to stay ahead in the market.

Summary Table: Leading Innovations and Applications

| Innovation / Application | Descripción | Example Manufacturers |

|---|---|---|

| Ultra-thin Films | Reduced thickness for cost and sustainability | Toray, Cosmo Films |

| Nano-Coatings | Added functions like anti-static, printability | Jindal Poly Films, SKC Co. |

| Improved Metal Adhesion | Uniform metallization for better performance | DuPont Teijin Films, Ester Ltd. |

| Biodegradable/Recyclable Films | Eco-friendly PET variants | Uflex Ltd. (ECOFLEX®), Toray |

| Packaging Applications | Flexible food and pharma packaging with excellent barrier | All major brands |

| Electrical Insulation and Shielding | EMI/RFI shielding in electronic components | Mitsubishi Polyester Film |

| Paneles solares | High-transmission backsheets and protective layers | Toray (Lumiflex®) |

| Automotive Components | Insulation and decorative films in vehicles | Taghleef Industries, Terphane |

The evolving landscape of metalized PET films shows a clear trend: manufacturers are pushing the limits of technology to create thinner, stronger, and more eco-friendly films. The applications stretch across packaging, electronics, automotive, and renewable energy sectors. At the same time, sustainability is no longer optional — it is integral to innovation and product design. That’s why understanding these applications and breakthroughs is key when you want to identify leading manufacturers of metalized PET films.

How Do Regional Trends and Market Dynamics Affect Metalized PET Film Production and Supply?

When you identify leading manufacturers of metalized PET films, you naturally look at how regional trends shape their production and supply. Understanding these links helps grasp why some markets surge ahead, while others face challenges. Let’s dig deep into how regions and market dynamics affect metalized PET film output, pricing, and availability worldwide.

Asia-Pacific: Production Powerhouse and Consumption Giant

The Asia-Pacific region leads both in producing and consuming metalized PET films. Countries like China and India are at the forefront.

- China is a manufacturing giant improving its capacity with modern machines and a vast workforce.

- India has grown rapidly with companies like Cosmo Films and Jindal Poly Films ramping up production and innovation.

This growth is tied to booming packaging sectors, rising electronics manufacturing, and expanding automotive industries in these economies. Rapid urbanization fuels demand for packaged goods, electrical components, and vehicle parts—all needing metalized PET films.

| País | Market Role | Key Players | Growth Drivers |

|---|---|---|---|

| China | Largest producer & consumer | Guangdong Weifu, Jiaxing Pengxiang | Manufacturing scale, export focus, urbanization |

| India | Fastest growing market | Cosmo Films, Jindal Poly Films | Packaging demand, electronics assembly, automotive |

Regional Strengths of Notable Manufacturers

Each region shows unique strengths in production technology, sustainability, and market reach.

- Cosmo Films (India) focuses on sustainability and advanced metallization coating. Their acquisition of Nippon Gohsei’s metallization unit added significant technical depth.

- Jindal Poly Films (India) drives innovation in barrier films with eco-friendly product lines like ECOFLEX®.

- Toray Industries (Japan) leads with high-performance films featuring superior barrier properties and solar applications (Lumiflex® line). They invest heavily in R&D.

- Taghleef Industries (UAE) utilizes advanced machinery covering BOPP and CPP films with strong emphasis on sustainability and customer-specific solutions.

Together, these companies exemplify regional specializations—whether low-cost scale in India or high-tech, premium products in Japan and UAE.

Market Growth Drivers: Why Demand Surges Regionally

Several key sectors push metalized PET film demand:

- Embalaje tops the list with over 50% market share. Food, pharmaceuticals, and consumer goods need durable, visually appealing metalized films that block oxygen, moisture, and light.

- Electrónica require films with precise electrical insulation and reflectivity.

- Automoción growth, especially electric vehicles, drives demand for films that tolerate high temperatures and provide superior barrier properties.

- Urbanization expands consumption patterns in developing areas, increasing packaging volumes.

This sector mix varies by region but consistently fuels market expansion globally.

Supply Chain Value Analysis: From Raw Materials to Market

Understanding supply chains helps identify availability and cost factors.

| Value Chain Stage | Key Factors | Regional Impact |

|---|---|---|

| Raw Material Supply | Resin cost & availability | Lower cost in Asia; higher import costs in others |

| Conversion & Coating | Technological upgrades, process efficiency | Japan and UAE lead in high-tech coating |

| Distribution | Infrastructure and logistics costs | Developed in Asia-Pacific, less so elsewhere |

- Raw materials suppliers provide PET resin and aluminum for metallization. Asia-Pacific has competitive resin producers, reducing input cost.

- Converters and metallizers handle coating and transforming base films to metalized products.

- Distributors and logistics ensure timely delivery to end users.

Regions with integrated supply chains (like India) gain a cost advantage, while others depend on imports, influencing product pricing and lead times.

Pricing Strategies and Cost-Effectiveness by Region

Pricing in metalized PET films depends heavily on production costs and market conditions.

- Asia-Pacific manufacturers leverage scale and local raw materials to offer competitive pricing.

- Japan and UAE producers target premium segments with advanced, costly films.

- Europe and North America often rely on imports, driving higher prices.

Manufacturers balance pricing with quality and innovation to maintain market share. For example, Toray’s high-value Lumiflex® justifies higher prices due to superior performance. Conversely, Indian producers focus on volume and cost efficiency.

Macroeconomic Indicators Shaping Market Expansion

Large economic factors influence production capacity and investment plans:

- GDP growth in Asia-Pacific supports consumption and industrial output.

- Currency fluctuations affect import costs of raw materials or machinery.

- Trade policies and tariffs impact cross-border supply.

- Energy costs influence manufacturing expenses directly.

The recent global push for sustainability and green technologies also steers investments towards eco-friendly metalized films, particularly in developed regions.

Strategic Partnerships, Acquisitions, and E-commerce Channels

Market penetration increasingly depends on collaborations:

- Cosmo Films’ acquisition of Nippon Gohsei’s metallization unit expanded technological capabilities.

- Taghleef Industries’ partnerships enhanced their product range and geographic reach.

- E-commerce platforms now support smaller volume orders, boosting accessibility.

These moves reduce entry barriers in tough markets, improve product portfolios, and accelerate customer acquisition.

Which Regions Lead in Metalized PET Film Manufacturing?

Asia-Pacific clearly leads, with China and India at its core. Japan adds a high-tech edge, while UAE’s Taghleef Industries shows Middle East strength.

How Do Regional Market Conditions Influence Production and Pricing?

Regions with integrated raw materials and efficient supply chains, such as India and China, enjoy lower costs and stable pricing. High labor or energy expenses in Japan raise production costs but allow premium product positioning.

What Supply Chain Factors Affect Availability and Cost in Different Regions?

Proximity to raw material sources, quality of conversion technology, and logistics infrastructure define availability. Asia’s local resin producers and converters smooth supply chains, while import reliance in some areas can cause delays and cost spikes.

The regional makeup of metalized PET film production is complex and layered. Knowing these market dynamics lets you identify leading manufacturers and understand how regional advantages shape their success in the global metalized PET film space.

Conclusion

Identifying leading metalized PET film manufacturers involves considering their product innovation, sustainability practices, regional market presence, and strategic investment. Companies like DuPont Teijin Films, Mitsubishi Polyester Film, SKC Co., Toray Plastics, and Jindal Poly Films stand out due to their expertise and market reach.

The metalized PET market continues evolving with applications spanning packaging, electronics, automotive, and solar energy sectors. Regional trends, technology innovations, and sustainability goals strongly influence production strategies and supply dynamics worldwide. Understanding these intertwined factors helps in recognizing market leaders and anticipating future shifts in this vital industry.

FAQs about Identify leading manufacturers of metalized PET films

Who are the top manufacturers of metalized PET films?

The top manufacturers of metalized PET films include DuPont Teijin Films, Mitsubishi Polyester Film, SKC Co., Toray Plastics, and Jindal Poly Films, each recognized for their unique strengths in technology, production capacity, and market presence.

What applications drive the demand for metalized PET films?

Metalized PET films are primarily used in packaging, electrical insulation, automotive components, and solar panels due to their excellent barrier properties, flexibility, and durability.

What technological innovations set leading metalized PET film manufacturers apart?

Key innovations include ultra-thin film production, nano-coatings for anti-static and antimicrobial properties, advanced surface treatments for printability, and improved metal adhesion techniques enhancing barrier performance.

How do regional trends influence metalized PET film production?

The Asia-Pacific region, led by China and India, dominates production and consumption driven by expanding packaging and automotive industries, while Europe and North America focus on niche and high-value film products.

What sustainability practices are implemented by metalized PET film manufacturers?

Leading manufacturers develop biodegradable and recyclable films, use eco-friendly raw materials and energy-efficient processes, and engage in circular economy initiatives to meet environmental regulations and consumer demands.

The metalized PET film market is shaped by top manufacturers like DuPont Teijin and Mitsubishi. Their unique products and strong tech drive industry growth. Applications range from packaging to solar panels, thanks to their excellent barrier properties. Innovations focus on thinner films and eco-friendly designs. Asia-Pacific leads production with key players in China, India, and Japan. Regional market trends and partnerships impact supply and cost. Understanding these factors helps you grasp how this vital film shapes many industries today.